“Will my insurance cover it?” I hear this question every day, and I get it. You pay for insurance, they should do their part and pay. That’s the point, right? Unfortunately, they are in the business of making money, and that ultimately means they need more money to come in than going out. That translates into you paying your premiums every month, but them denying payment on your treatment for reasons that can be a little ridiculous. It’s just the name of the game for them.

At the end of the day, they hold all of the power, and there isn’t much we can do about it as individuals. The power to change these big companies lies with politicians. Considering that these companies pay politicians (lobby) to pass laws in their favor, I’d say our odds aren’t very good. We’ll just have to work with all the information we can get to maximize the existing benefits. This is intended as a basic guide to help you ask your dental insurance company the right questions, and to understand some basic parts of common dental insurance policies. It is geared toward missing teeth and dental implant procedures, but it applies to most dental procedures. Ideally, you’ll do this before signing up with them. If you already pay for a plan, these questions are still extremely valuable to help you understand their coverage for dental implants.

**This is solely meant as a guide to start a discussion with your insurance company to better understand your dental insurance benefits.

A little lingo you should know.

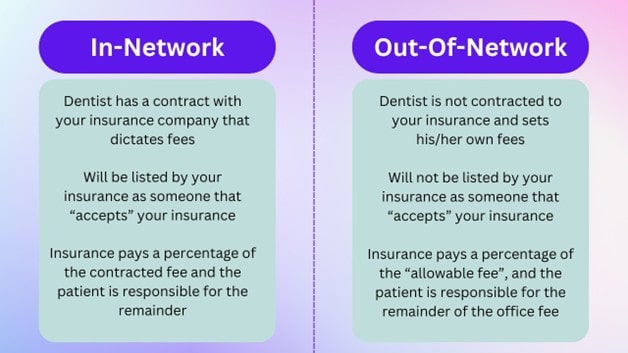

In-network provider: A dentist is referred to as in-network, or a participating provider, when they sign a contract agreeing to offer dental services at pre-negotiated rates. This means that in-network practices must charge the rates set by the insurance plan.

Out-of-network provider: An out-of-network dentist is a dental provider that is not contracted with the insurance company to accept negotiated rates. An important thing to remember is that even though a provider might be out-of-network with your plan, many plans still have benefits with great coverage at an out-of-network provider. When an insurance company says they cover “X%” of a certain procedure, such as tooth extractions for example, they are referring to how much the insurance plan will cover of the “allowable fee”.

Allowable fees: Allowable fees, or allowed amounts, are the maximum amounts an insurance plan will pay for a covered service. If a provider charges more than the allowable fee, the patient will be responsible for the full payment of the difference. Let’s go over a real life example of how this shakes out.

Let’s say you want to get a top denture, so you call your insurance and they say, “Yes, we cover 100% of top dentures.” What they normally don’t tell you is that they mean 100% of the insurance’s allowable fee. Your dentist’s office fee for a top denture is $1,000, but the insurance company’s allowable fee is $800. This means your insurance **should** pay $800, and you will still owe $200. It is a mystery why the insurance companies are not more up front about this when patients call.

Missing tooth clause: If your plan has a missing tooth clause, and a tooth was lost or extracted prior to your policy going into effect, then the insurance will not cover the replacement of that tooth. Remember at the beginning of this article where we said insurances do their best to avoid paying out claims? This is one of the most common ways we see them get out of paying claims.

Dental codes: The American Dental Association (ADA) maintains a list of standardized coding for all dental practices in the U.S. This means that every procedure a dentist does has a specific code. It would look something like D1011. This is how communication is standardized between all dentists and 3rd parties such as insurance companies.

Frequency: Dental insurances use the term Frequency to define a period of time a patient must wait before a code becomes eligible for coverage again. One of the most common procedures with frequency limitations is dentures. If your insurance has a frequency limitation of 5 years for dentures, for example, this means they will only pay their portion on a new set of dentures every 5 years.

Consider this real life example: If your dog were to get a hold of, and use your dentures as a chew toy two years after you had them made, most dental insurances would not yet payout on a new set. The most common denture frequency we see is one arch per five years. Keeping with the same example, you would either be responsible for paying 100% of the replacement denture fee or you would need to wait three more years to replace it under your policy. Providing your dentist with accurate details on when previous dental work was done is vital in their ability to provide you with an accurate insurance estimate.

Estimate: All numbers that are given by insurance companies are always an estimate. Even if an official predetermination is completed and insurance says they will pay X amount, they still sometimes don’t pay that amount or any at all. They hold all the cards and there isn’t much we can do in these situations.

Common insurance characteristics you should know!

Waiting Period: This waiting period pertains to when you get a new dental insurance policy. It is the amount of time you have to wait before your policy will actually start paying for treatment.

For example, if you get a new dental insurance policy in January, it might have a 6 month waiting period. This means that they won’t help you pay for any dental treatment until July at the earliest. Different insurances have different waiting periods, so always ask about this when you get new insurance.

Annual max: An annual maximum is exactly what it sounds like, the most an insurance company will pay on your policy over the course of a year. While not all dental policies have an annual max, most do. This is one of the most common misconceptions we see regarding insurance.

Just because the policy states it will pay a certain percentage on a dental procedure, that payment will not exceed the annual max. Ask your insurance company or your HR department what your annual maximum is on your dental insurance!

What time of year does your insurance reset: Most dental policies reset on January 1st. If you were to have teeth extracted on December 28th and then implants placed on January 3rd, more often than not these procedures would count towards different annual maximums.

Insurance companies are extremely slow: As you are no doubt aware, insurance companies are big businesses. Most employ thousands of people and have a wide range of departments. Even if we give them the benefit of the doubt and assume they are trying their hardest, it can take time for the claims filed to be processed. A lot of time. It is not uncommon for an insurance company to take 2-3 months to process a simple claim. Even if we call them every day, it does not speed up this process.

Predetermination: A pre-determination, or a pre-authorization, is a tool for dental providers and patients to get the best possible ESTIMATE of coverage for a treatment plan. It works almost exactly like filing a claim after a procedure. We take the codes from your treatment plan, attach necessary x-rays and narratives, and submit it to the insurance claims department. They review the pre-determination and return an Expectation of Benefits that lists each code and what they expect to pay, as well as what fees fall on the patient to pay. While an Expectation of Benefits is not a guarantee, it does strengthen the likelihood of payment.

An important thing to note is that we will submit the pre-determination as soon as we are able, typically the same day as the initial consultation. However, from that point on it can take a while to get a response. Once it is submitted it is fully up to the insurance company on how long it

takes. Many patients who want to begin treatment quickly get frustrated because it can take weeks sometimes to receive an EOB. Please understand that we are doing all we can to get a timely response on your behalf, including calling them frequently to try and track information that might be available more quickly than waiting on mail to arrive.

Not all plans are created equal. One of the most common insurance questions we get when scheduling consultations is, “Do you accept my insurance? I have Humana.” This is a much more complicated question than most people realize. The fact is, most insurance companies have a wide range of available plans, each with an even wider range of covered procedures and limitations. While one plan may have out-of-network benefits, another might require you to see an in-network provider. Likewise, some plans cover certain procedures while others do not. This is why we check benefits at the time of the initial consultation and is another factor in why we offer the initial consultation at no cost to the patient. We want you to have as much information and be as comfortable and confident as possible on what to expect moving towards your new smile!

Ask your dental insurance about coverage on these specific codes!

There are hundreds of dental codes. When it comes to implants, there are a basic few that it would be a good idea to call your insurance and ask if/how they are covered. Here are a handful of the most common dental codes pertaining to dental implants. These are common codes and your insurance company should be able to easily and clearly tell you about your coverage for these codes.

Sedation: If you want to, or plan to, be sedated with a pill or with an IV, these are the codes you should ask your dental insurance about.

- D9248: Non-Intravenous Conscious Sedation – Also referred to as oral sedation. You take a pill to relax.

- D9239: Intravenous moderate (conscious) sedation/anesthesia – This is the IV sedation that your dentist will perform if he/she is a general dentist. It is split into two codes, one for the first 15 minutes, and then a separate code for each 15 minute increment after that.

- D9243: IV moderate (conscious) sedation/anesthesia – subsequent 15 minutes

- D9222: IV Deep Sedation/Anesthesia – First 15 minutes. This is similar to moderate sedation above, except this is performed by oral surgeons or by a general dentist that brings in a CRNA or Anesthesiologist. It is split into two separate codes, one for the first 15 minutes, and one for subsequent 15 minute increments as well.

- D9223: IV Deep Sedation/Anesthesia – Subsequent 15 minutes.

Extractions: Dental extractions are one of the most commonly covered services under dental insurance plans. These are the two most common codes. Your dentist will determine which code is appropriate.

- D7140: Simple Extraction

- D7210: Surgical Extraction of Erupted Tooth

Bone Grafting: Bone grafting is a complicated procedure with many different codes. Most insurances don’t cover complex grafting. They mostly only cover what we call “socket grafting” or “ridge preservation”, if they cover grafting at all. I’ll put that code first, and that’s the only one you should ask about unless you know you’ll need some other more specific kind of graft such as a sinus lift.

- D7953: Bone Replacement Graft for Ridge Preservation – This is the code for a bone graft when a tooth is pulled. This is far and away the most common type of graft, and the only one you should ask your insurance about if you do not currently have a treatment plan from a dentist.

- D7950: Osseus, Osteoperiosteal, or Cartilage Graft of the Mandible or Maxilla -This is a bone graft for a tooth or teeth that are already missing, and the bone needs to be built wider.

- D7951: Sinus Augmentation with Bone or Bone Substitutes via Lateral Open Approach – This is a sinus lift in which a small “window” is opened into the sinus and a bone graft is done directly into the side of the sinus.

- D7952: Sinus Augmentation via Vertical Approach – This is a sinus lift in which bone is placed straight through the implant site into the sinus, and the implant is placed on top of it.

- The above three are the other more common complex bone grafts. Those 4 codes will cover about 95%+ of bone grafting procedures that are done.

Dentures: There are two types of dentures, called immediate denture and complete dentures. When you have teeth pulled (any amount of teeth, even 1) and you receive a denture immediately, that is considered an immediate denture. If you have NO teeth and you receive a denture, this is considered a complete denture.

Dentures are the most common item for frequency to come into play. If you remember from earlier, frequency means how often dental insurance will pay for the same code.

- D5130: Immediate Denture – Maxillary (Upper)

- D5140: Immediate Denture – Mandibular (Lower)

- D5110: Complete Denture – Maxillary

- D5120: Complete Denture – Mandibular

Partial Dentures: For a full in depth view of partial dentures, read our article! (have a link to partial article)

- D5211: Maxillary Partial Denture – Resin Base

- D5212: Mandibular Partial Denture – Resin Base

- D5213: Maxillar Cast Metal Partial Denture

- D5214: Mandibular Cast Metal Partial Denture

Dental Implants: These are the common codes pertaining to the placement of dental implants, and the placement of teeth on them. For more information on the parts of an implant, read this article (link implant parts article).

- D6010: Surgical Placement of Implant Body; Endosteal Implant – This is the placement of a dental implant into your bone. It does not include anything else, only that specific surgical procedure.

These are the two options for the abutment that attaches to the implant. Your dentist will determine which one is appropriate for your specific situation.

- D6056: Prefabricated Abutment

- D6057: Custom Fabricated Abutment

- D6058: Abutment Supported Porcelain/Ceramic Crown – This is the tooth that attaches to the abutment, which attaches to the dental implant.

After reading this guide, you should be able to have a conversation with your insurance company and better understand your dental insurance benefits. These are the most common items pertaining to dental insurance and replacing missing teeth or bad teeth. You can be prepared before going to your dentist’s office so you’ll know what kind of treatment can work for you!

Blake Vidrine DDS